Articles

- Suze Orman: Which Unusual Method of Strengthening Wide range You’ll Transform That which you If you are Tired of Low Production – Learn More Here

- Best Casino To try out That it Position the real deal Currency

- Finest Web based casinos Bonuses

- Homeownership has been ‘okay’ for Boomers… in addition to their infants often luck aside too

The newest Boomers’ want to protect its independence is promoting an Learn More Here elevated you need for custodial proper care services in which people let in the home. People in which generation are to find more in the-homecare gadgets, such as medical alert solutions, reading helps, and you will electronic therapy dispensers, too. The former hippies was less likely to want to talk out today than Millennials that a lot more modern to your societal points. Seniors thrived for the giving support to the entire family members equipment which have a good married number of parents whereas Millennials are quicker concerned about taking partnered and more going to help homosexual wedding. Also they are very likely to contain the legalization away from cannabis and therefore are less likely to want to end up being spiritual. Age bracket X used the new Boomers, and so they have been followed by Millennials.

Suze Orman: Which Unusual Method of Strengthening Wide range You’ll Transform That which you If you are Tired of Low Production – Learn More Here

Baby boomers along with, an average of, has a far larger display of the nation’s money than simply millennials after they had been a similar ages — 21 per cent than the millennials’ cuatro.six %. GOBankingRates works together of a lot monetary advertisers to help you reveal items and you may features to our visitors. Such names compensate me to promote their products in the adverts across our very own site.

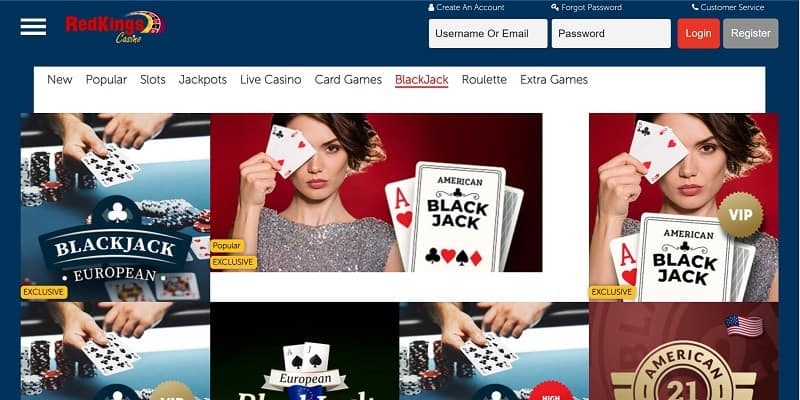

Best Casino To try out That it Position the real deal Currency

Yourdon was not the initial in her members of the family for economic let to have a recently available household get. The woman sister has also been offered money to cover a down commission to the a property, and therefore Yourdon known as one of the greatest difficulties up against young grownups seeking be home owners. Therefore, boomers were greatest establish to amass the newest riches which they’ve accumulated now.

The remainder number is inspired by personal businesses during the $17.step one trillion. Us citizens provides approximately $156 trillion in the possessions, centered on Visual Capitalist, but 1 / 2 of one to wide range — $78.1 trillion — belongs to the seniors. The remainder is actually spread out around the Age group X, the brand new Silent Age bracket and you can Millennials. As well as soaring as well as housing costs, today’s young adults deal with most other economic demands the parents did not at this many years. Not merely try its earnings straight down than just their parents’ income when they was within twenties and 30s, once modifying for rising prices, but they are as well as holding big education loan balance, recent records reveal. If the Koncaks’ struggles which have health care can cost you since the the elderly sounds familiar, it’s since they’re.

Finest Web based casinos Bonuses

When you’re keen on online slots and seeking for a good games that will make you stay amused for hours on end, take a look at the child Bloomers position. That it fascinating online game is stuffed with colourful graphics, fun animated graphics, plus the chance to earn big prizes. On this page, we’ll plunge on the why are the baby Bloomers position thus special and exactly why it’s vital-wager one position fan.

Discover and you will honest interaction gamble a life threatening part when helping Kid Boomers navigate financial complexities, specifically early in old age. Which have later years, for each age group has various other concerns and challenges. The fresh rising prices prices were computed playing with SmartAsset’s rising cost of living calculator. “Whatever you’d wear their insurance rates you’ll should claim while the a secured asset,” Mazzarella said. With regards to the latest S&P CoreLogic Situation-Shiller List, home prices had been 16.six % higher the 2009 Get compared to 12 months earlier, the most significant gain inside thirty years. Smaller metropolitan areas specifically have begun observe volatile progress, with individuals more often getting off the newest coasts and you may on the reduced towns — and in turn driving upwards home prices.

Homeownership has been ‘okay’ for Boomers… in addition to their infants often luck aside too

User durables owned by baby boomers can be worth $2.98 trillion, because the consumer durables belonging to millennials stack up to help you a great property value $step 1.55 trillion. Pension entitlements make up ten.8% of one’s millennials’ wide range, 17% is fastened various other possessions, 11.8% in the user durables, twelve.7% independently enterprises and 5.5% inside the business equities and you may shared finance. Within the 1998, the newest Western inhabitants below 40 years kept 13.1% away from The united states’s full riches. Thus millennials and Age bracket X individual fewer than half of your own money you to old years owned when they have been the brand new same decades. One another groups of boomers tend to have loads of retirement deals, nevertheless top middle class is more apt to be taking getaways and also have a little more discretionary income. Next, obviously, we would like to deduct your debts, as well as mortgage loans, car and truck loans, personal loans, credit debt, money owed on the a business bought or offered and back fees, among others.

They just need open the internet browser the spot where the Adobe Flash Plugin try meant to start the game. The conventional symbols setting successful combos of the same photos. They all are place close to both in the exact same energetic spend line of kept so you can best.

We explore investigation-motivated techniques to test financial products and you may features – our recommendations and reviews commonly influenced by entrepreneurs. Look for a little more about the article guidance and all of our things and you can services opinion strategy. Wealth is normally gathered in the form of discounts, opportunities, or other types of assets, as well as a property. The fresh Government Set-aside actions simply how much riches is actually gathered because of the for every generational age bracket inside entirety.

Merchandising arbitrage concerns attending stores — such Large Plenty, Burlington, Target, Individual Joe’s, Walmart, Marshalls, Ross and TJ Maxx — and buying discounted items that you can sell on line to own an excellent cash. Since the Manager away from Blogs in the TheCelebrityCafe.com, Angela led a major international party situated in Tokyo, innovating the new site’s posts approach and you may introducing a profitable internship program one to expanded growing ability. As they get older – and you will give – the fresh resulting “Silver Tsunami” tends to pass on just what Freddie experts try calling a “Trend away from Wide range” due to their college students or any other heirs. Within the Infant Bloomers, the fundamental paytable include 5 lowest-using and you can step 3 high-using signs. The new large-using symbols are designed because the a bunny, a tiny sheep, and a great duck. The earnings are determined from the kind of indexes away from 2x to help you 1000x.

- To construct as often — or more — wide range while the boomers, younger years would need to make the most of compounding focus.

- The infant Bloomers position has a top RTP rate, providing players a good threat of profitable.

- Because the number your arrived at after subtracting debts from property offers a sense of their classification, the fact is that you’re in a position to live more or quicker richly centered on your geographical area, Mazzarella told you.

- Observe that not all the states allow it to be notary finalizing representatives to aid close financing and may also provides other limitations.

While the millennials handle ascending home prices due to high demand and you will limited likewise have, he is to shop for house reduced appear to and later than years just before her or him. Millennials should be considering setting up an estate plan. They understand a lot better than anyone that unforeseen incidents may appear at the any time. Establishing at least an elementary Trust otherwise Tend to offer a comfort with the knowledge that debt items is dialed inside the, but if one thing goes. Inside the 1989, 40-year-dated boomers got an average earnings of $70,100, average wealth of $112,100000 and average loans out of $60,one hundred thousand. Alternatively, millennials do have more personal debt in accordance with their earnings and accumulated wide range.

Millennials had been produced anywhere between 1981 and you may 1996, and they are currently old ranging from twenty five and you may 40. Baby boomers were created between 1946 and you will 1964, and they are already aged ranging from 57 and you will 75. As a result, the significant money import away from seniors to help you young generations one to scientists has predict may possibly not be so great anyway, as much out of older Americans’ money goes to healthcare. GOBankingRates’ article party is actually dedicated to bringing you objective analysis and you can guidance.

Because the boomers get into old age, they ought to be thinking about how they can assistance more youthful generations. Building generational wealth will take time, but here are a few suggests more youthful years you will get caught up to help you baby boomers. Out of baby boomers still operating, the new median amount of savings they believe it’ll must end up being financially safer inside senior years is $750,100, considering a study held from the Transamerica Cardiovascular system. But not, the average employee in this age group have protected just $202,100. You could potentially argue that Gen X had it a lot better than one almost every other age bracket.

To aid paint the picture, let’s define exactly what millennials don’t has. Considering Bloomberg, millennials only keep 4.six per cent of your own wealth in the usa. He’s ten times wealthier than millennials, and you may doubly wealthy than just Gen X. But not, analysis from previous years imply that the new pit shouldn’t become as big as it’s today. Concurrently, millennials are experiencing to wait much longer on the riches wave to make, where they’ll begin to inherit wealth off their moms and dads.